- Trading Advice for Losers

- Posts

- Top Trading Tips for 2025 - Part 2

Top Trading Tips for 2025 - Part 2

A review of what I've learned so far this year, and a preview of what's next.

⭐ Join our subscriber community at mwright.com ⭐

Introduction

Welcome back, and our new subscribers, thank you for subscribing. 2025 has been an eventful year. In this newsletter, I’ll share my findings from the second half of 2025, and give you some insight into what’s next for my top stock picks and for me personally.

2025 Year in Review - Part 2

▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂▂

Using screening logic that I found in a Reddit post, I started looking at, then trading, stocks that had pre-market volume that was greater than previous daily volume. I talked about it in my “1 Day Rockets” series of Youtube videos (the most watched videos on the channel, to date. I was finding more success in trading short, because, more often than not, the stocks would hit a high, and fall from there for the rest of the day.

YouTubers @Ross Cameron - Warrior Trading and @TreydingStocks are some examples of traders using a variation of this method.

@Ross Cameron - Warrior Trading on Youtube

I reviewed the use of PositionSizeCalculator.net to help people understand what a good exit point might look like for a trade. I also framed the concept of “exiting a trade” using an actual Facebook marketplace transaction I did when I bought a banjo for $250 (worth $400-$500 retail). Instead of holding it longer to get the retail price, I flipped it in a day for $300. Should I have held it to make more, or was I right to get the base hit and take profit immediately?

The banjo that I sold on FB Marketplace

I also bought an embroidery machine for $450, but the opportunity to sell it at retail came up immediately. So, I sold it for $1099. The lesson: take what you can get, or like what Chris Sain says, “when you see profit, take profit”.

The meat of this article was a discussion about a 3 month study I did that was based on the 100 Baggers that I wrote about previously. I posted my selection of 100 Baggers on X.com, daily, then added them to a spreadsheet. According to the spreadsheet, those picks - collectively - were beating the S&P 500 in the second month, and by 3x in the third month. $RGC actually became a 100 Bagger in that time period.

I also posted this analysis in a Youtube video and in a video on TradingView, which garnered me a TradingView Editors’ Pick award. I still trade my longer term positions base on this analysis.

Next, I went into a little more detail into my own portfolio and trades, which, at that time, was consistently beating the S&P 500. Again, these positions were largely entered into based on my 100 Baggers filtering method. I also introduced, for the first time, a sneak peak at the PositionSizeCalculator.net Companion Spreadsheet, which I was using to track my portfolio’s performance.

PosiitonSizeCalculator.net Companion Spreadsheet

I also won another TradingView Editor’s Pick award for an article that helped other developers use one of TradingView’s newer methods - log.info() - to debug their code. And, the garden was off to a great start. Here’s a photo of my first sunflower in full bloom

Mo’s Garden Sunflower

I had an epiphany about the AI ecosystem that showed me that because the core AI players will serve as the underlying engines of an AI-based economy, when we pay for 2nd-tier apps, we will actually be paying for use of the 1st-tier models multiple times through multiple subscriptions. Cha-ching!

I tied this to a great video, “This One Metric Predicted Winning Stocks for 23 Years”, by @Investor52 on Youtube that gave a compelling argument saying that 5 year sales revenue growth of over 50% has a direct correlation to future stock price success. In short, winners keep on winning.

Because the performance differentiation between those who use AI and those who don’t will be significant, paying for AI subscriptions will be mandatory in order to be competitive - at almost every level. So, as hyped as AI has become, its long-term impact is very real, people will pay for it, and AI companies that can establish a base now will win big long-term.

What’s Next?

Following the last newsletter’s 2025 recap, what I’ve done mostly is sit on the trades I entered using my 100 Baggers strategy. See “100 Baggers Performance”. But, I also did a lot of paper trading on a strategy that I thought could actually be something - momentum trading on high pre-market volume - discussed earlier.

I was actually able to double a paper account on 4 occasions using a combination of multi-timeframe order blocks, VWAP, and various custom volume indicators. But, I also managed to blow up 5 different paper accounts. And, the live accounts did not perform well at all. So, even with the potential gains that I’ve seen, the strategy was too volatile for me to continue.

This brings us to today. Over the past 2+ years my goal was to build a sustainable income from trading. Although, for the bulk of this year, my trades were actually performing well, the profits did not outpace my expenses. For this reason, I closed out all trades, and began to focus more deeply on my core capabilities around web design and development.

In the process of learning about technical trading, I’ve

Built 200+ indicators, with 10 of them being open source and public available on TradingView

Received 6000+ cumulative “Boosts” on TradingView for my indicators

Created 30+ Youtube videos on trading strategies, tools, and targets

Written 20+ newsletters for this mailing list where I shared my findings, good and bad.

Built a browser extension for TradingView,

Built a position size calculator and an accompanying spreadsheet.

The non-Pinescript tools were built using Cursor AI, a vibe-coding platform that is a MUST-HAVE for any developer. This includes the tools, as well as their accompanying websites.

Unfortunately, in order to make ends meet I made the choice to go back to where I started from - design and development of high performance, one page websites. Now, with AI tooling I can include the new essentials: AI voice agents, AI chatbots, and AI video and visual assets.

With support from the most high, maybe I’ll be able to architect, position, sell another $20M business. If you need help with yours, or just need some help with trading tools, hit me up at websitedesignberkeley.com and follow me on Instagram at @websitedesignberkeley, where I occasionally test out my AI video editing skills with some off-beat storylines.

Weekly Stock Picks: $GOOGL, $HWM ( ▲ 6.52% )

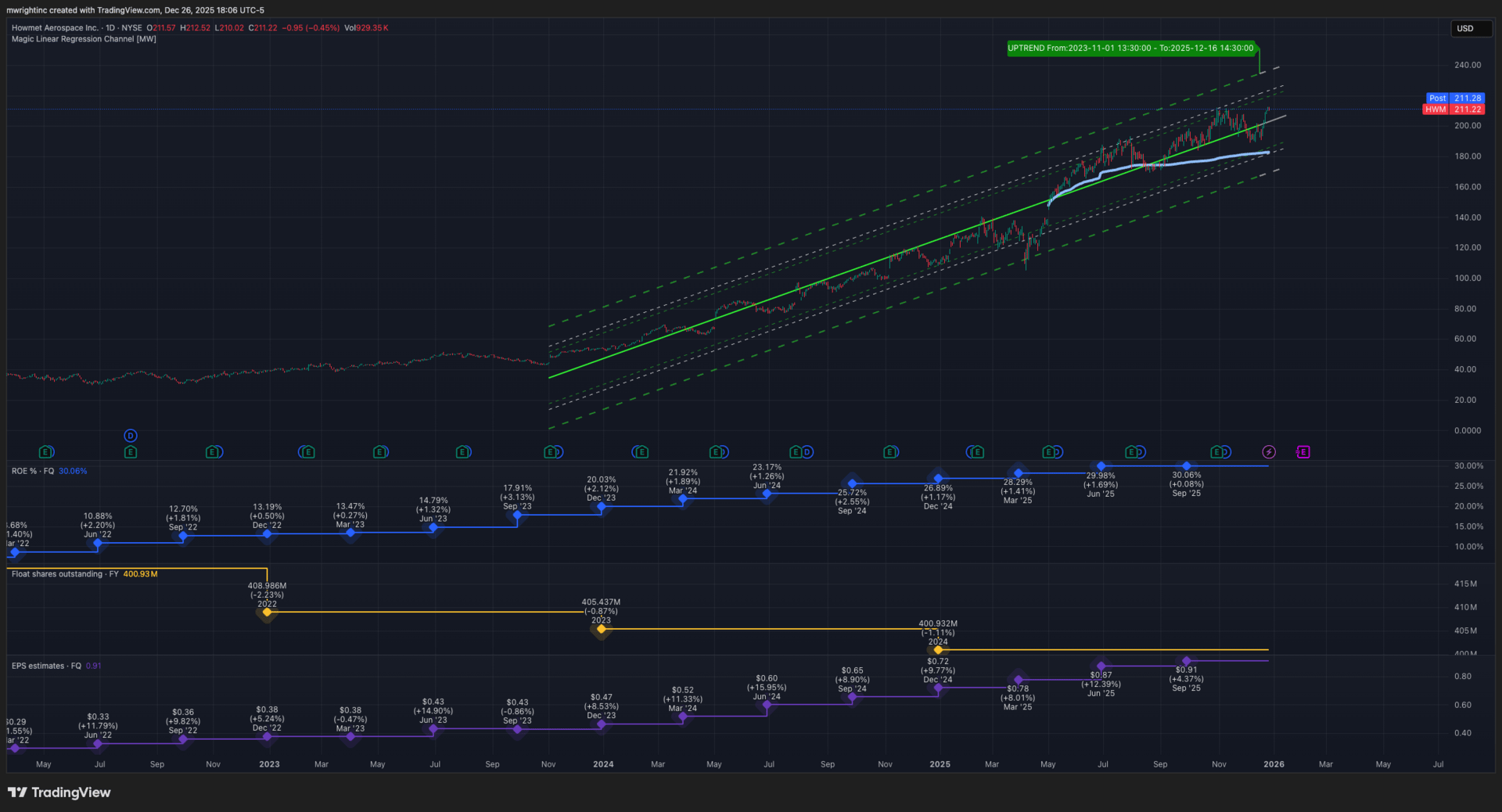

Both $GOOGL and $HWM are showing very strong long-term charts. However, $GOOGL is at the top of a 3-year channel, and $HWM has just crossed above the midline of its 3-year channel. $GOOGL may be ready for a short-term pullback, but both charts show consistently rising ROE and EPS, as well as consistently decreasing float. Better earnings and financial performance + fewer shares => higher demand.

$GOOGL Daily Chart

$HWM Daily Chart

More Resources

Free tools that you can use today to improve your trading

Free TradingView indicators you can use right now in your account. Don’t have a TradingView account. Click this link to get one.

Other cool tools

The End

If you like this newsletter, let me know, and please share. If you don’t like it, please tell me why, and I’ll do my best to make it better. And remembre, if you have any questions, feel free to reach out to me on Reddit, X.com, TradingView, or Youtube. If for some reason you forget, you can always get those details from the footer at mwright.com