- Trading Advice for Losers

- Posts

- Beating the S&P 500

Beating the S&P 500

Using the TradingView Stock Screener

⭐ Join our subscriber community at mwright.com ⭐

Introduction

Welcome back. As I mentioned in the last email, I received the Editors’ Pick from TradingView. My phone was lit up with new TradingView followers and boosts on the script, and apparently a few new subscribers. In this issue, we’ll cover some of the key topics from that video, but I’ll also share with you a gem that I found, HigherHighs.com. We’ll also go over our Weekly Stock picks. Let’s go.

TradingView Editors’ Pick: “Beating the S&P 500 with TradingView’s Stock Screener”

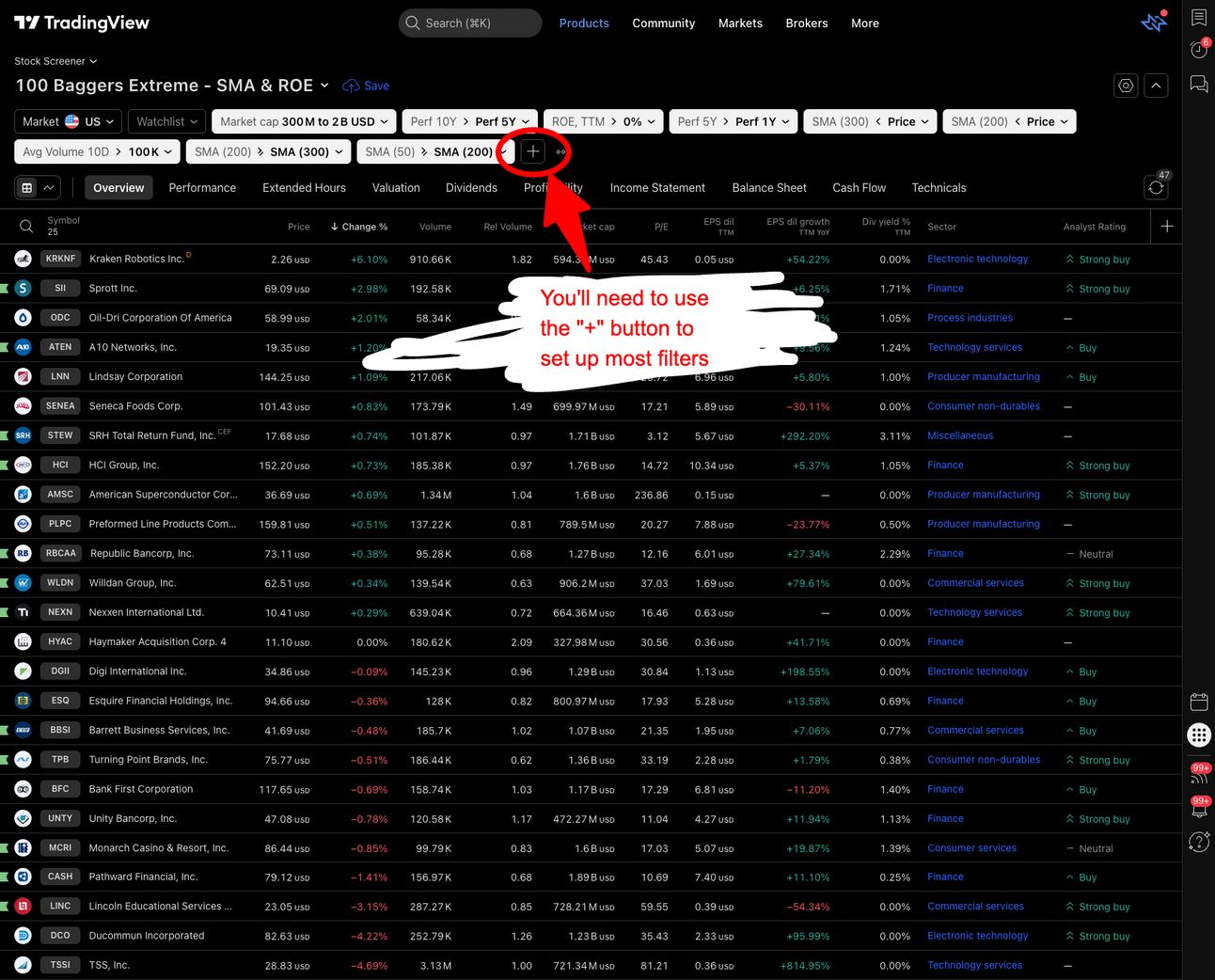

Some new candy popped up on the scanner last week, $AMSC, $RBCAA, $ODC, $MCRI, $UNTY, $DCO . After reviewing the charts, they all looked good for medium length holds, but $AMSC, $ODC, and $DCO didn’t look favorable short term. Maybe after a week or so they’ll be ready if they don’t have a major meltdown.

An additional note is that both $RBCAA AND $MCRI, in addition to having fulfilled the screener conditions, and having a steadily increasing ROE (Return on Equity), their floats (or available shares) has been steadily going down. That means that supply is going down, while demand may be going up. A great recipe for a price jump. Just saying. For more detail on why I’m sold on this process, you can read the past article, “100 Baggers Performance”.

1 Day Chart for $RBCAA and $MCRI

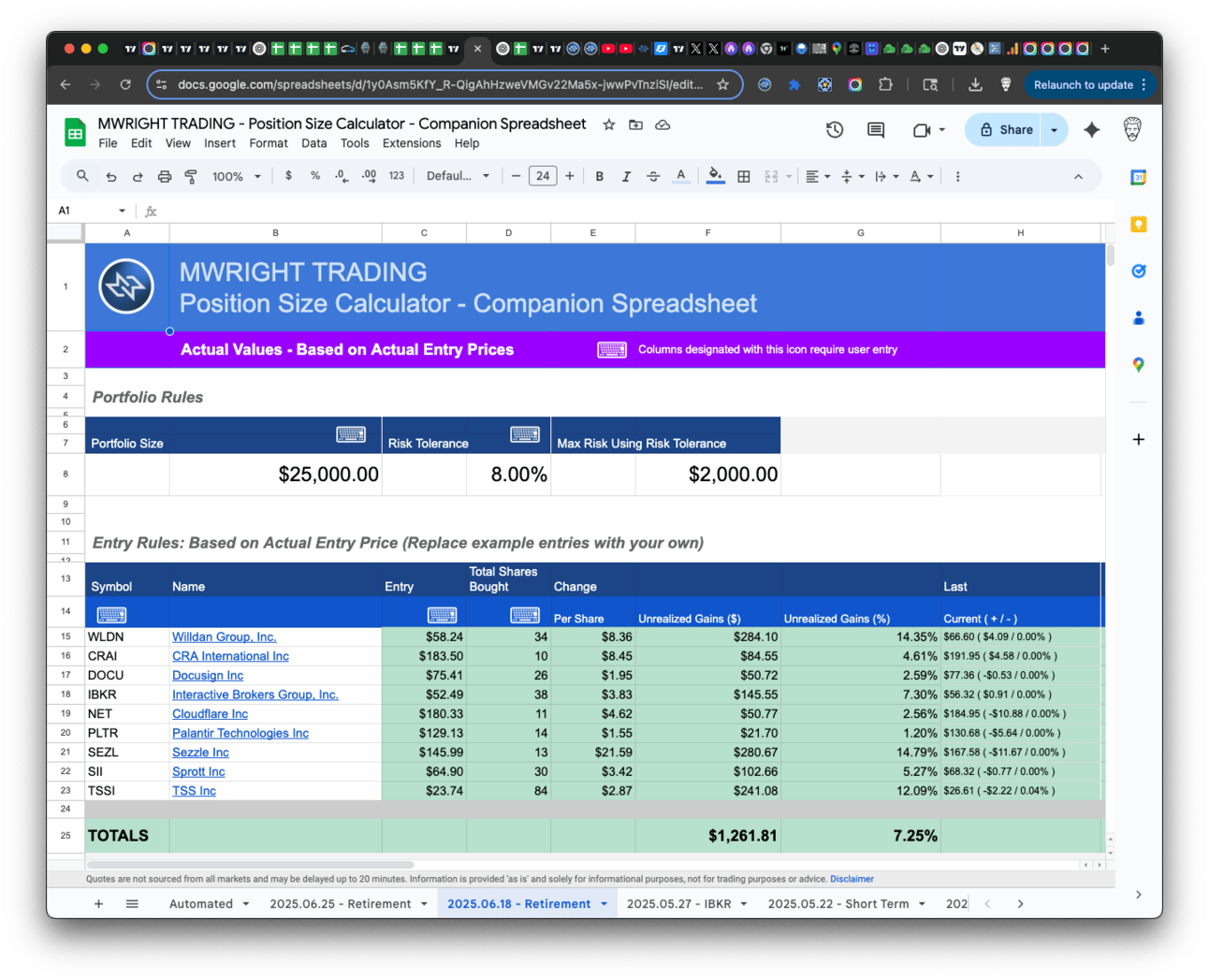

For reference, the picks that I shared in the last newsletter on June 22, 2025, and that I entered on June 18, 2025 are pictured below using the PositionsSizeCalculator.net Companion Spreadsheet. Those positions are up 7.25% since June 18th. Not a bad apple in the bunch.

Performance on the previous weekly stock picks from my own portfolio using the PositionSizeCalculator.net Companion Spreadsheet

I’ve since added $RBCAA and $MCRI. How did I find these, that’s the topic of this newsletter.

Beating the S&P 500

This weekend my video on beating the S&P 500 using TradingView’s stock screener was selected as an Editors’ Pick by TradingView. You can view the full video on Youtube, or the abbreviated, TradingView-safe version here.

But, why? What made it so compelling?

The S&P 500 is THE benchmark used by just about everyone to determine if you’re trading successfully or not. What I’ve found is that if you want to beat the S&P 500, it might be a good idea to start with strong equities that are already beating the S&P 500.

To that end, I showed people how to find those stocks reliably. Here are the requirements:

Let’s Build a Screener

These are the properties I look for in something I intend to spend money on:

Liquidity - that means money being spent on an equity, or some trading volume.

Room to move - no overhead resistance, and room to grow.

Favorable trends - this is reflected in stable moving averages.

Good short term signals - A good intraday chart, which can be analyzed using some of our indicators.

TradingView Screener Page

Here are the specs:

Market Cap 300M to 2B - Not too big, and not too small

Perf 10Y > Perf 5Y - No long term dips in performance

Perf 5Y > Perf 1Y - No short term dips in performance

SMA(300) < Price - Price above moving average

SMA(200) < Price - Price above moving average

Avg Volume 10D > 100K - No lightly traded stocks. Liquidity needed

This will get you a nice list of 20 to 50 stocks to scrub. But, for even more accuracy, I add the following filters:

SMA(200) >= SMA(300) - Stacked long-term simple moving averages

SMA(50 >= SMA(200) - Stacked mid-term simple moving averages

ROE, Trailing 12 Months > 0% - Improving ROE (Return on Equity)

After this, you have to use the charts.

Review the charts

Verify short term performance

Multi-VWAP [MW] (1 hr Chart) - Above a rising 5-Day AVWAP

Magic Order Blocks [MW] (5 min Chart) - No major overhead resistance

Verify fundamentals and long term performance

ROE (Quarterly) - Rising ROE

Float Shares Outstanding - Lower float means lower supply. When high demand occurs, this can act as a price catalyst.

Multi VWAP from Gaps [MW] - Stacked is good

3 Daily SMAs (50, 200, 300) - Stacked is good - specifically for the daily chart

If you can do this on your own, more power to you. But, if you can’t check out the Youtube video.

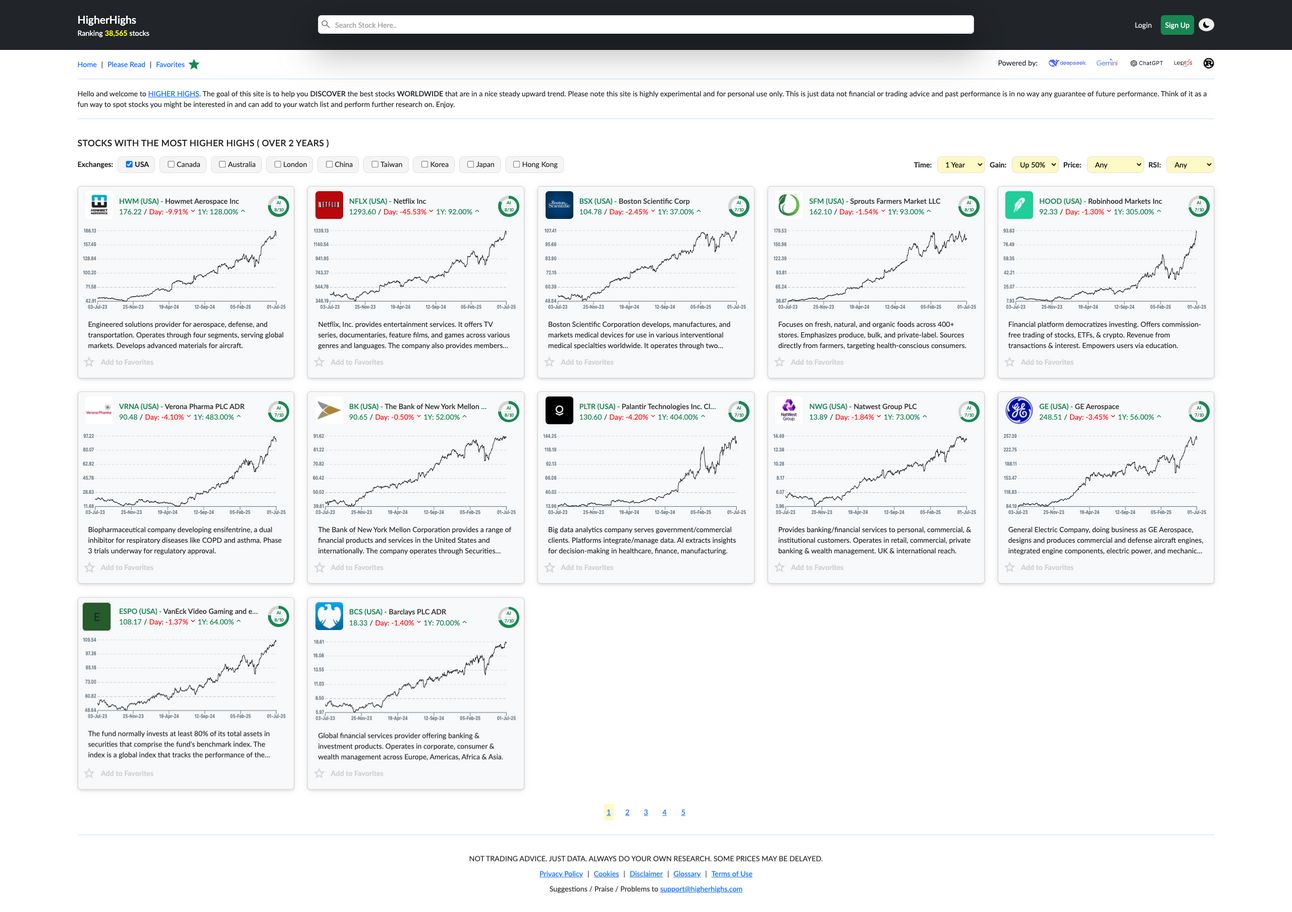

In the process of building out this content, a TradingView moderator, @zAngus, reached out to me about my video that showed how to use TradingView’s screener to find “1 Day Rockets”. He liked it. I looked at his profile, and in it I found a link to one of his websites, HigherHighs.com. It is, what we in the industry like to call, “a stunner”. Okay, I’m the only one that says that.

HigherHighs.com counts the number of higher closing highs for each day for a given stock. Apparently, the more, the better. There is also an AI layer that ranks the stock charts that are listed. Not surprisingly, a lot of the past weekly stock picks from this newsletter shows up on their list. That’s how I know it’s legit. 😉

HigherHighs.com

Additionally, HigherHighs.com isn’t limited to just US markets. They have everything. It looks like a pretty expensive setup since you would need to be able to retrieve all of the yearly data for all of the stocks, so that you can perform all of the higher high calculations. Then, you have to have an AI model perform a ranking of all of the stocks.

When I brought this up with @zAngus, his response was, “Yeah, its not cheap”. LOL! It’s his personal side project. So, if you want to find good stocks and support an indie developer, make sure to sigh up. It’s a resource you should add to your arsenal. Because I think it’s so important, it will have a permanent home in our More Resources footer.

Since we’re on the subject of web sites, I recently updated https://mwright.com to include updates to both the newsletter and to the Youtube channel as well as some of the testimonials my tools and content have collected over the past few months. So, if you like “what The Rock is cooking”, give me a shout.

More Resources

Free tools that you can use today to improve your trading

Free TradingView indicators you can use right now in your account. Don’t have a TradingView account. Click this link to get one.

Other cool tools

The End

If you like this newsletter, let me know, and please share. If you don’t like it, please tell me why, and I’ll do my best to make it better. And remembre, if you have any questions, feel free to reach out to me on Reddit, X.com, TradingView, or Youtube. If for some reason you forget, you can always get those details from the footer at mwright.com