- Trading Advice for Losers

- Posts

- Exiting a Trade

Exiting a Trade

When you see profit, take profit

⭐ Join our subscriber community at mwright.com ⭐

Introduction

Welcome back. In this issue, we’ll talk about exiting both market and real world transactions. My 100 Bagger filter actually uncovered a 100 Bagger that occurred over the last few months. We’ll cover what happened after the last issue on momentum trading. Lastly, we’ll review some data on 100 Baggers, and what it has to do with new positions that I’ve recently opened.

I entered each of these positions this week. Some of these you may recognize from previous newsletters where I went over my enhanced 100 Bagger screener. Some, you may recognize from the 100 Baggers screener that I’ve been using to post daily on X.com. What brings these together is the increasing ROE (Return on Equity) that each of these have shown over the past few years, in addition to my 100 Bagger screening criteria. For more detail on that, you can read the past article, “100 Baggers Performance”.

1 Day Chart for $WLDN, $TSSI, & $SEZL Including Quarterly ROE and 50, 200, & 300 SMAs

Although my swing trades have generally been better than my day trades, using 100 Bagger filtering has definitely improved that area of my trading. It is also worth mentioning that 2 tickers on my shortlist, $CTAS and $KRKNF, two very good stocks, were both falling below a declining 5 day VWAP, which you can see using the Multi VWAP [MW] indicator on TradingView. Once they recapture that 5 day VWAP, I may enter positions with those two as well.

Modelling Multiple Orders Using PositionsSizeCalculator.net

I should also mention that initiating multiple orders simultaneously is so much easier with the Position Size Calculator at http://positionsizecalculator.net . You can set your trade amount on multiple stocks and get your quantities, real-time entry prices, as well as stop and take profit amounts all on one easy to understand screen.

Exiting a Trade

Last weekend I bought and sold a Ludwig resonant tenor banjo. I bought at $200. The banjo was worth from $400-$500. I sold it for $250 with a $6 listing cost at EBay. That’s a net $44 gain.

Banjos aren’t what the kids are really getting into these days. I could have held it longer and went for the +$200, but one discovery I made this week was that most of my futures trades would have been profitable if I had exited at $50.

Ludwig Resonant Tenor Banjo - Sold for $250

In each case, instead of waiting for a larger payday, going for the base hit is a better move for some strategies. This is similar to Brian Shannon’s approach of exiting 1/3 of a position as soon as it goes in his direction. Then use a 1:1 reward to risk ratio for the next exit, then 2:1, then 3:1, then leave “runners”.

Base Hit

I could have kept the banjo longer with the POTENTIAL for higher profits, but $50 for a 24 hour flip isn’t bad. Likewise, with my futures trading, I’ll be moving my stops so that if a trade goes up $50, that amount will get booked at the very least.

This weekend I bought an embroidery machine. I bought at $450. It was worth $1200 with the accessories and travel bags it came with. I sold it for $1099. Minus taxes and fees, it sold for $1000. Because I got an offer within 24 hours after posting it on Facebook Marketplace, I didn’t have to wait for a larger payday.

Not all transactions happen like this, but I’m starting to find that it makes sense, for me at least, to take what you’re given.

I noticed something about my futures trading in the past week. $SPY has been in a consolidation pattern, so it’s been a challenge to reliably capture a big move. I kept holding onto trades that were going positive by 3 points on /MES (S&P 500 Mini Futures), but then they would snap back down negative 3 points, which kept triggering my stops.

So, for this market, I started exiting at 2.5 points, and started collecting base hits. That first day using this strategy ended up being my first perfect futures trading day with 4 or more trades.

I guess the moral of he story is in a consolidating market, or in a market that has little volume (like in the case of the banjo), when you see profit, take profit. In a trending market, those same entries can have much more potential. But, unless you’re confident that is the case, take what you can get.

Trading 1 Day Rockets

Two weeks ago I also tried using my 1 Day Rocket trading technique on a live account, but ended up with 3 losses. At first, I thought that it was me. But, I saw that Ross Cameron, on the Warrior Trading channel on Youtube, who had been winning for 2 months straight was also coming against some red days. For a deeper dive into the strategy, check out the last newsletter, “$30K in 3 Weeks of Momentum Trading”.

To add insult to injury, I was trying to trade in both my paper account and my live account - at the same time. The small loss on the live account turned into a big $9K+ loss on the paper account early in the week, since it was difficult to act on both of them at the same time. Needless to say, I won’t be doing that again.

I was able to recover that $9K by the end of the week with some consistent trading.

This week I was able to bring the paper account to $150K (starting from $100K). Then, I started trading larger amounts to match with the larger account size and subsequently lost $25K trading long.

What this tells me is that the long strategy still isn’t as reliable as the short one. Just to confirm, I’ll try trading short again this week. In a live account, with my broker at least, I’ll need 3x the amount of the trade in the account in order to trade short, but for a reliable strategy, it might be worth trading smaller amounts. We’ll see.

A 100 Bagger

One of the stocks on our list of 100 Baggers actually became a 100 Bagger on 6/16/2025, $RGC. It was a top performer in March, and it was a 19-Bagger already when we featured it in our “100 Baggers Performance” newsletter. It first appeared on our list on 3/18/2025 at $0.74. On June 16th, it hit $83.60, but it has since fallen back to $38.01, as of Friday, 6/20/2025.

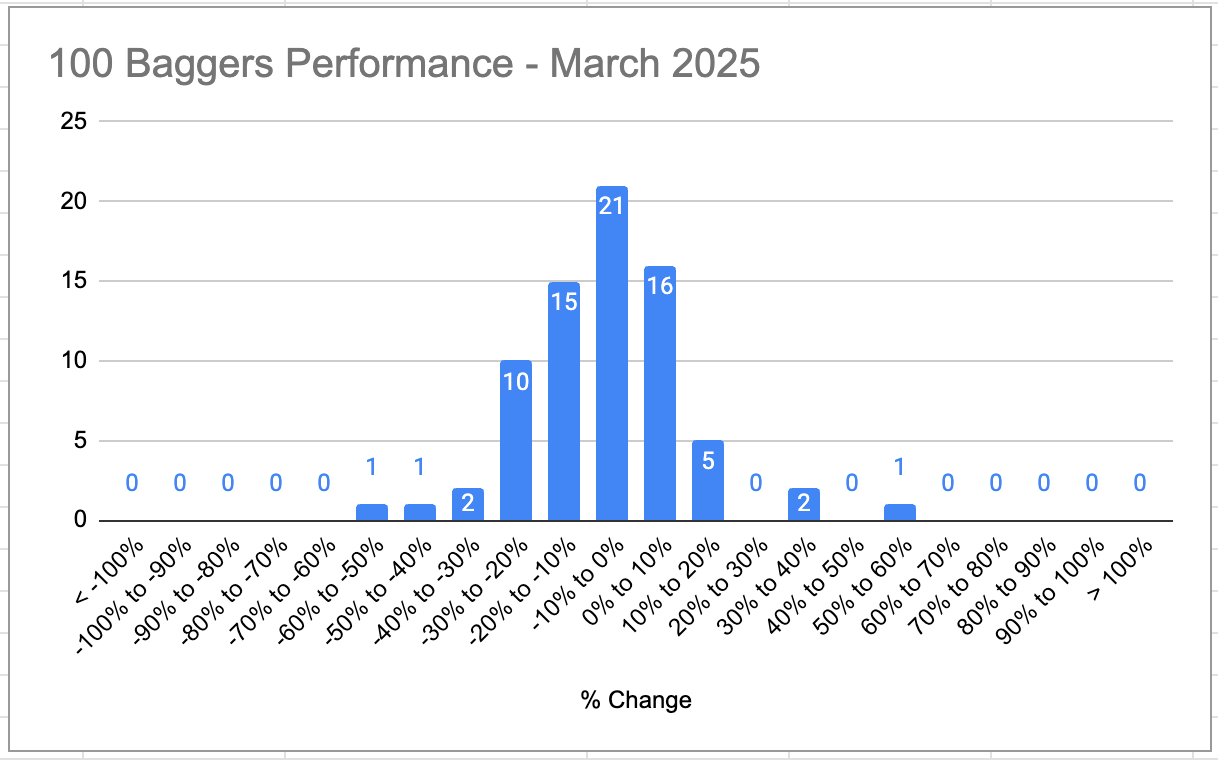

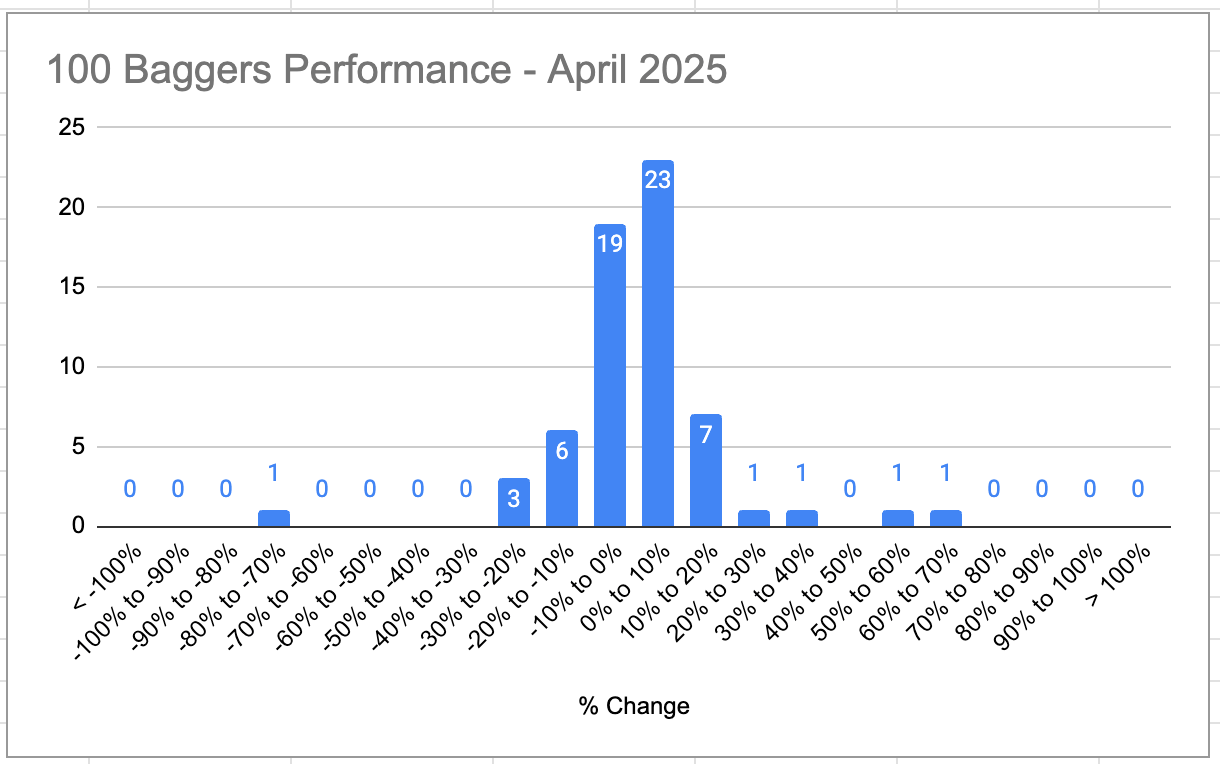

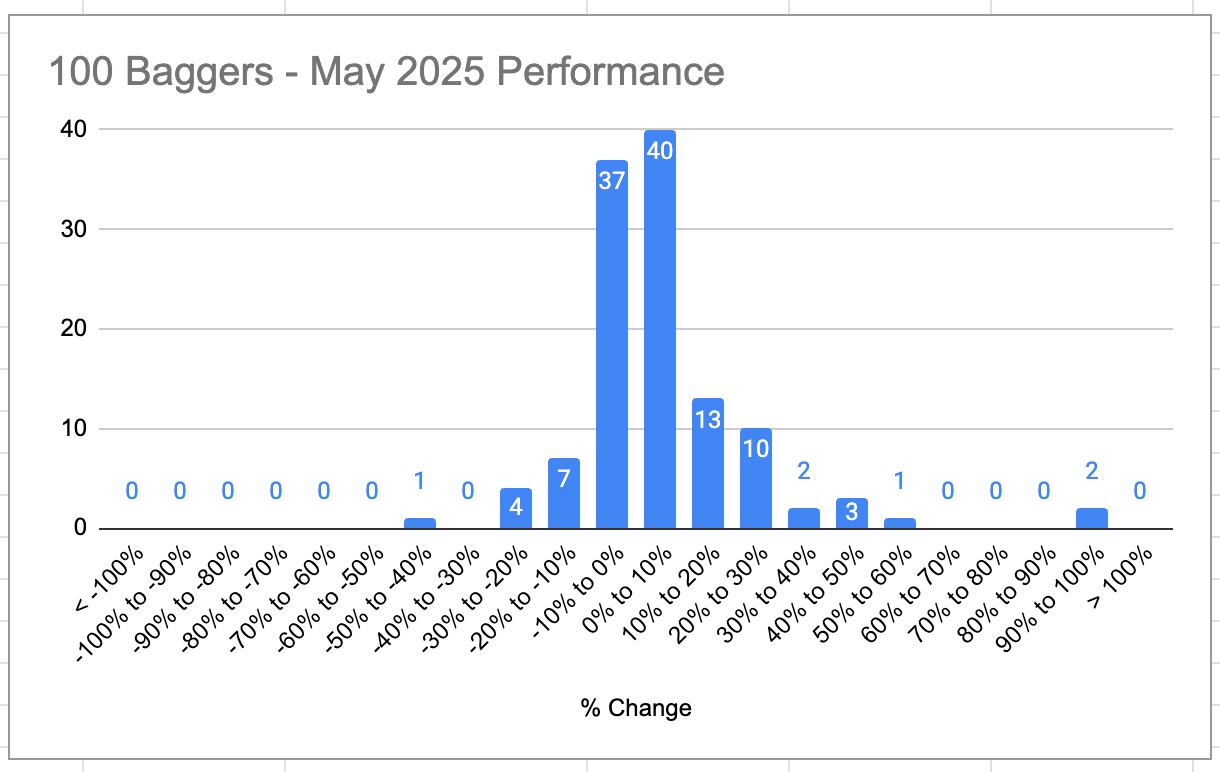

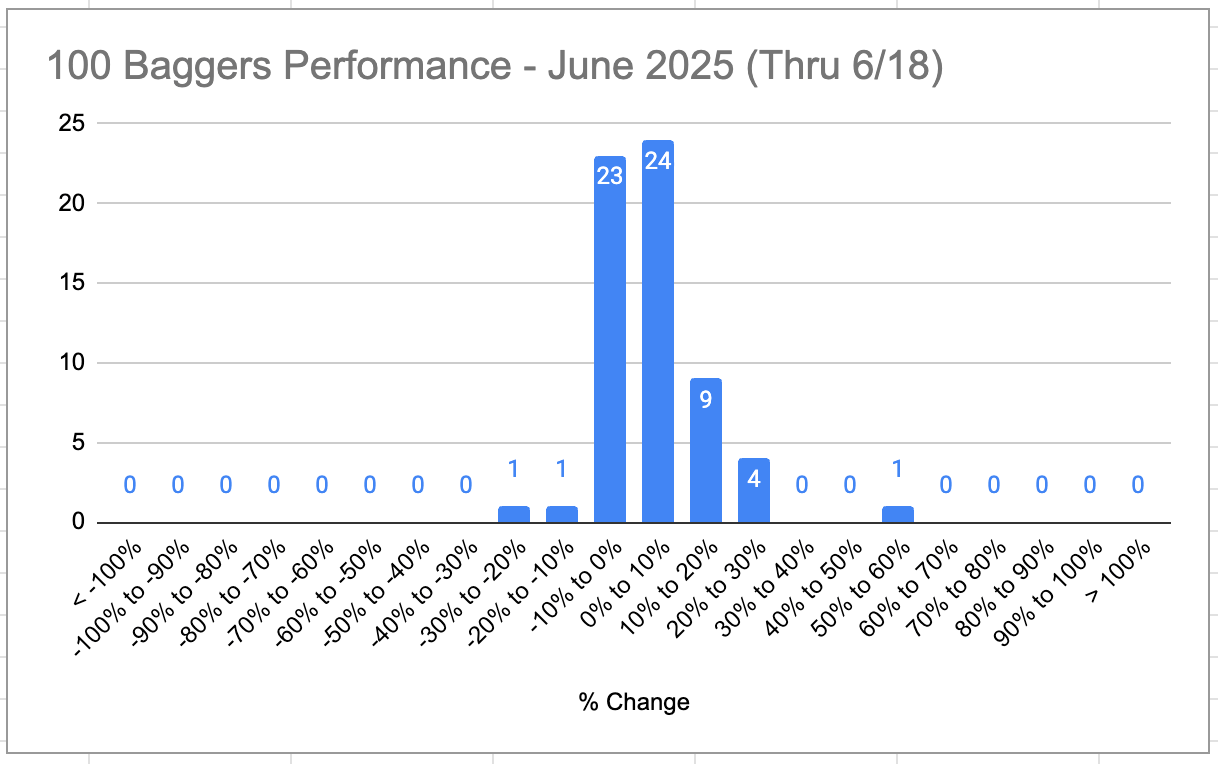

Also, now that we have data for the full month of May, we have more stats to share. In March, 8 of 77 tickers gained 10% or more, while only one ticker dropped more than 50%. In April, 11 of 64 tickers gained 10% or more, while only one ticker dropped by more than 50%. In May, 32 of 122 tickers listed gained 10% or more, while none dropped more than 50%. And, so far in June, 13 or 64 tickers gained 10% or more, and none have dropped by more than 25%. Except for March, there have been more winners than losers each month. But, even in March, there were 39 losers vs. 35 winners. Not bad for an extremely volatile month that saw a 6% drop in the S&P 500.

100 Baggers Performance - March 2025

100 Baggers Performance - April 2025

100 Baggers Performance - May 2025

100 Baggers Performance - June 2025 (Thru 6/18)

What this data suggests is that the screener I use selects stocks that will outperform the S&P 500 in up-markets and equal the S&P 500 in down markets. For that reason, I opened the new live positions I listed above.

More Resources

Free tools that you can use today to improve your trading

Free TradingView indicators you can use right now in your account. Don’t have a TradingView account. Click this link to get one.

The End

If you like this newsletter, let me know, and please share. If you don’t like it, please tell me why, and I’ll do my best to make it better. And remembre, if you have any questions, feel free to reach out to me on Reddit, X.com, TradingView, or Youtube. If for some reason you forget, you can always get those details from the footer at mwright.com