- Trading Advice for Losers

- Posts

- 100 Baggers Performance

100 Baggers Performance

Can you find them with TradingView's Stock Screener?

⭐ Join our subscriber community at mwright.com ⭐

Introduction

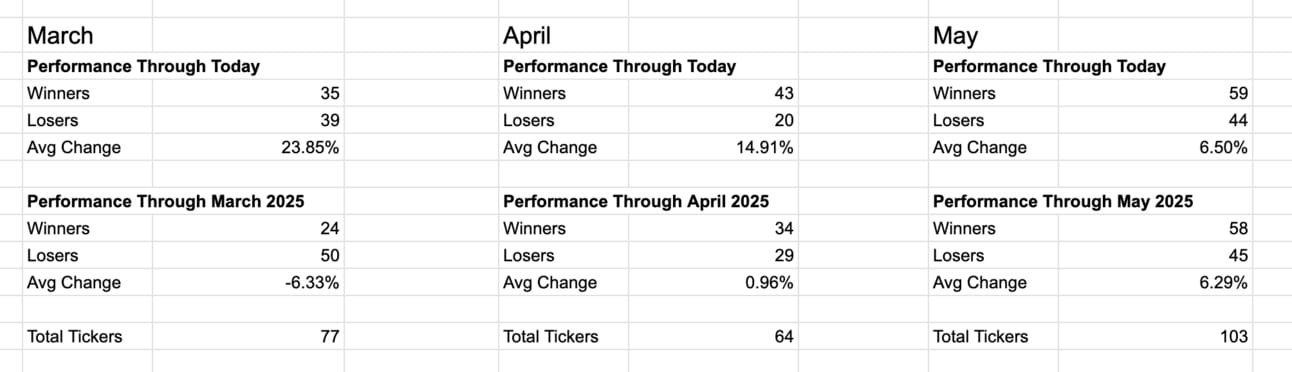

This issue is all about 100 Baggers, or stocks that have the potential of a 10,000% return. You’ll find out how the stocks that I screened greatly outperformed the S&P 500 over a 3 month period: a 23.85% return while the S&P 500 was down -2.86%. And, I’ll talk briefly about the book that kicked off my journey. Let’s get into it.

100 Baggers

I became obsessed with finding 100 Baggers after watching interviews of Chris Mayer, the author of “100 Baggers: Stocks That Return 100-to-1 And How To Find Them”. Based on what I heard him talk about, I made a stock screener for potential 100 Baggers on TradingView. Each day I built a list and posted it on the @mwright_com account on X.com.

“100 Baggers: Stocks That Return 100-to-1 And How To Find Them” by Christopher Mayer

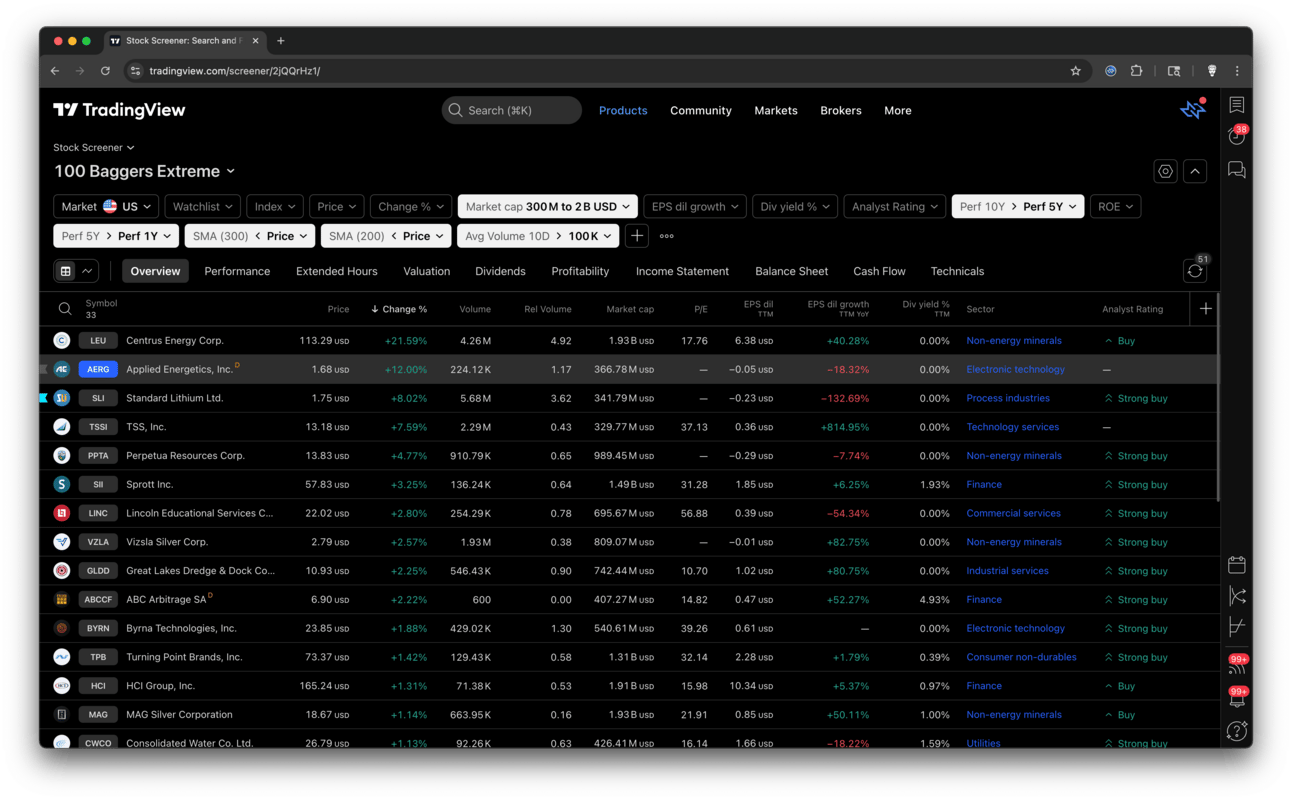

From the videos, my impression was that 100 Baggers are very consistent. So, the screener looked for stocks where the 10 year stock performance was greater than 5 year, and the 5 year was greater than the 1 year. I also filtered for mid-cap stocks (market cap between $300M and $2B), since the large caps don’t have room to grow another 100x. For consistency on a shorter timeframe, the price had to be above both the 200 and 300 daily simple moving averages (SMAs).

TradingView Screener - 100 Baggers Extreme

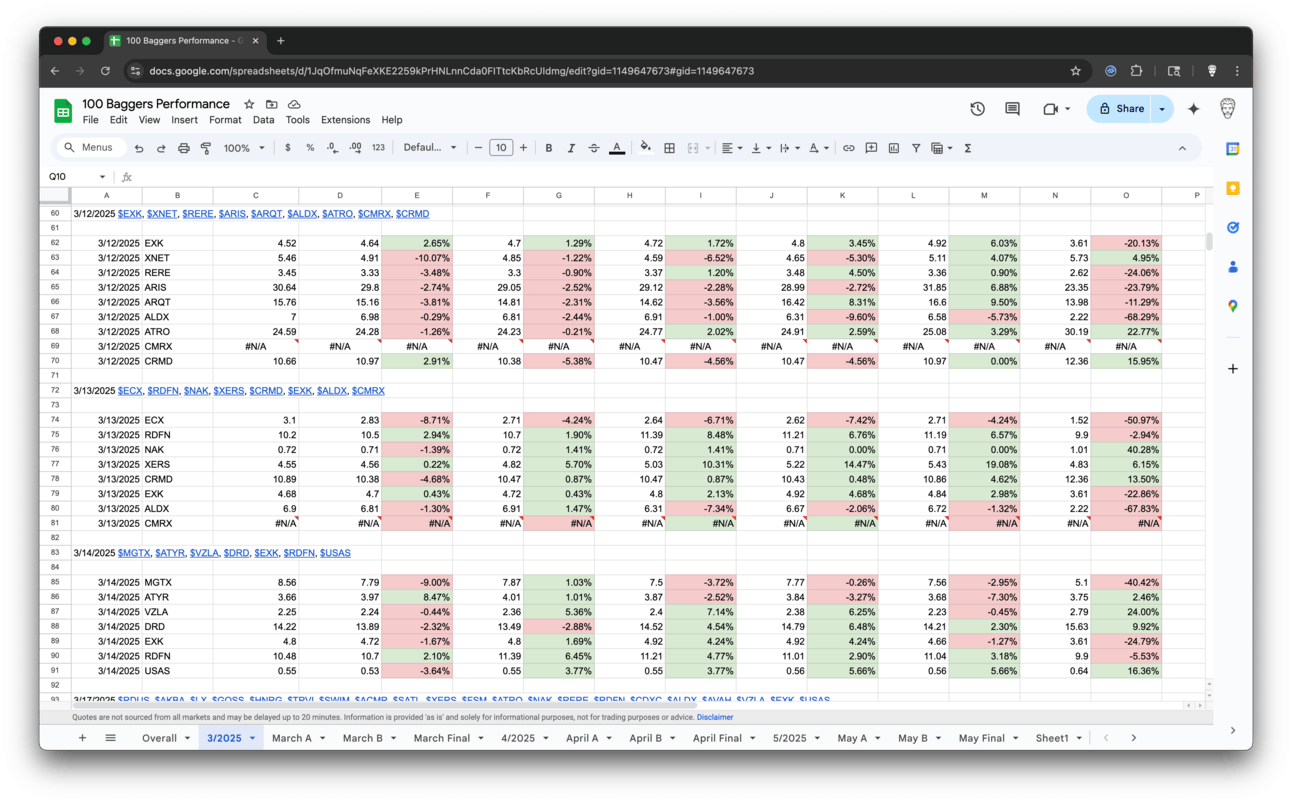

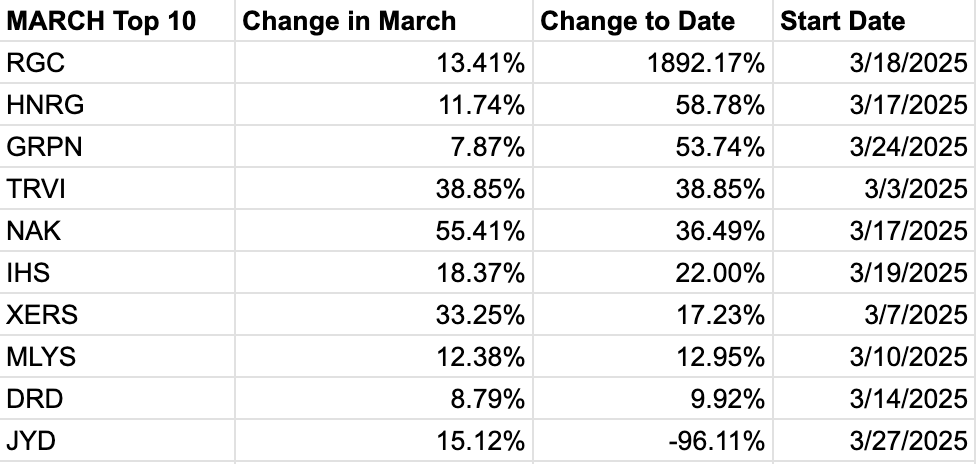

After building these lists daily for a few months, and sharing them on X.com, I decided to build a spreadsheet tracking the short-term and mid-term performance of the stocks from the screener based on the day that they first showed up on my radar. There were some surprises. There was one 10 Bagger, $RGC (+1892.17% - nearly a 20-Bagger as of 3/23/2025), and there was one total collapse $JYD (-96.11%).

Also, 5 tickers changed. Two were acquired, $CMRX and $ATSG, two were promoted to NASDAQ, $DEFTF -> $DEFT and $ABCCF -> $ABCA, and one just changed symbols outright $CDXC -> $NAGE. Unfortunately, I wasn’t able to clean up the data to account for all of these changes, but you can copy the spreadsheet and do your own due diligence. https://docs.google.com/spreadsheets/d/1lykKdLTQjdhrnb-J4QMvtiu3HoF71kpY_3GVPVxdsJI/edit?usp=sharing

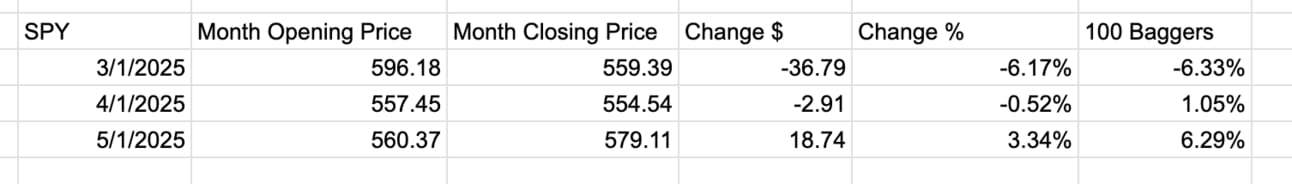

Overall, buying a complete set of the 100 Baggers (equally weighted) that was listed each day, and holding them through the end of the month, would have fell behind $SPY by -0.16% (-6.33% vs -6.17%) in March, and outperformed in April and May by 1.57% (1.05% vs -0.52%) and 2.95% (6.29% vs 3.34%) respectively.

100 Baggers Performance - Monthly

The magic, though, came when comparing 100 Baggers held for longer than a month. Buying and holding 100 Baggers, as they were announced did pretty well. Although, March’s numbers of -6.33% wasn’t spectacular, holding those same tickers through today would have yielded a +23.85% return. For April, the change was +14.87%. And for May, +6.05%. $SPY from March 1, 2025 had a price change of -2.86%.

100 Baggers Performance - Winners and Losers Count

So, although buying the 100 Baggers that were selected within a given month was marginally better than $SPY, their performance in subsequent months outpaced $SPY significantly.

In March, April, and May there have been 77, 64, and 103 unique tickers. The increase in May being mostly due to the bounce that followed the market correction that happened in March and April, with that correction pushing tickers back into the screener’s moving average thresholds.

March 2025 Top 10

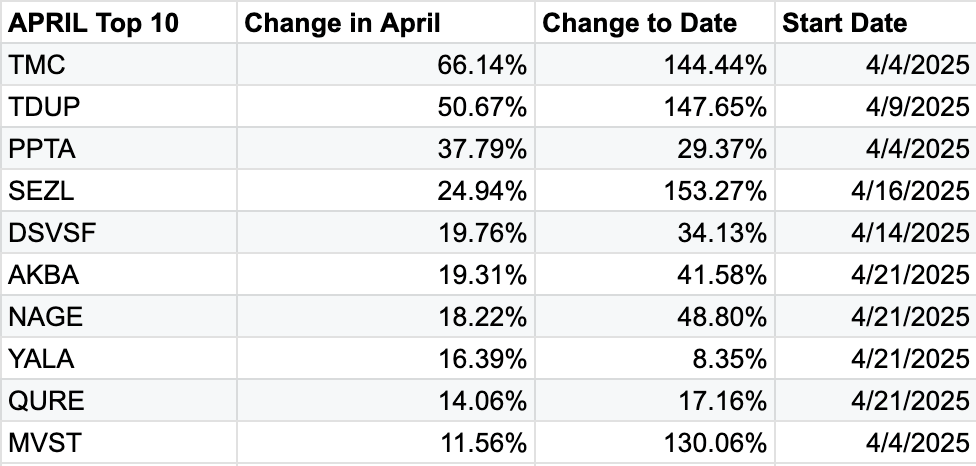

April 2025 Top 10

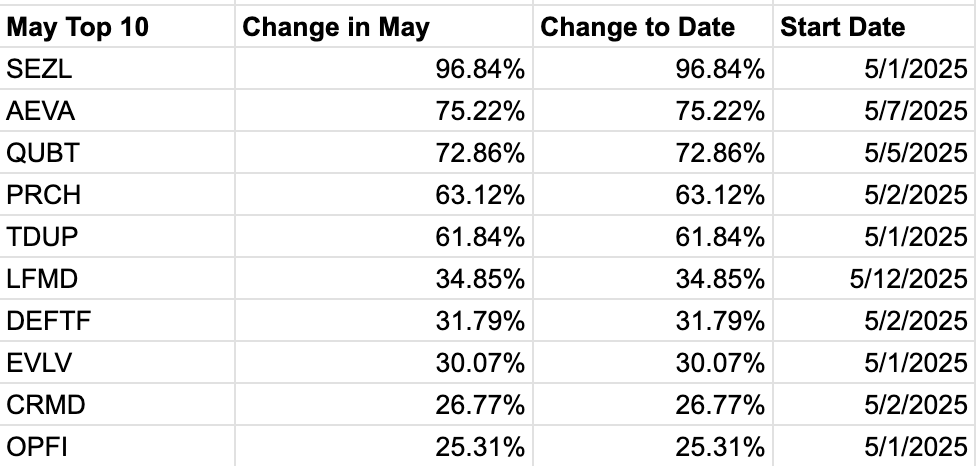

May 2025 Top 10 - Through 5/23/2025

Now, I’m actually reading the book - not just watching videos - and it doesn’t disappoint. I’m halfway through and there is a big addition that needs to be made to the screener to filter out the real 100 Baggers from the wannabes. That change would be an increasing return on equity, or ROE. Return on equity is the amount of profit returned compared to the amount invested. For example, an investment of $100 and a profit of $20 is a 20% ROE.

Also, to reinforce the need for consistent growth, I also intend to add filters that force the 50 daily SMA to be higher than the 200 daily SMA, and the 200 daily SMA to be higher than the 300 daily SMA. Adding both ROE and this new SMA condition brought a list of 37 tickers down to 15. Although this would have eliminated the champion, $RGC, if used in our past screenings, the remaining list - as of today - was very strong. Here it is:

You’re welcome.

In the book, Mayer made a specific point about about avoiding mining, minerals, and other very cyclical equities. In that regard, $MAG, and $FSM might have to get the boot. Looking at their charts over the past 10 years clearly demonstrates these intermittent crests and troughs.

And, although some of the top performers from the past few months would not appear on this new list, tickers like $TDUP, $SEZL, $NAGE, and $HNRG that kept popping up, for example, I have no doubt that there is at least one or more 100 Baggers among them.

Lastly, one thing mentioned in the book that cannot be easily accounted for in a stock screener (at least not to my knowledge), is the importance that an owner-operator has on building one of these illustrious outperformers. Growth was a major ingredient as far as Mayer was concerned. That can be can be filtered for with a screener. Even capital allocation, another significant attribute of 100 Baggers, can be tracked. A company that gets a 20% annual return because they reinvest capital is worth more than one that gives cash away as dividends, or just earns interest on the cash was the argument used for this criteria. This can be seen in R&D numbers.

Leaders, like Steve Jobs with Apple, Alex Karp with Palantir, Jensen Huang with Nvidia, Jeff Bezos with Amazon, and of course Elon Musk with Tesla, on the other hand, have no measurement that can be pulled up in TradingView that can accurately measure their vision and wisdom. Ironically, though, in Clayton Christensen’s and Jerry Porras’ iconic book, “Built to Last: Successful Habit of Visionary Companies”, they found little correlation between “great”, multi-generational, companies and charismatic leaders. Go figure.

So, there you have it. The 100 Baggers watchlist seems to work. Although, there is some level of patience involved, I am now convinced that stocks that perform consistently well over 5 to 10 years will probably continue to do so. Especially, if that consistency is reflected in shorter timeframes.

100 Baggers for Tuesday, 5/28/2025

$LEU, $AERG, $SLI, $TSSI, $PPTA, $SII, $LINC, $VZLA, $GLDD, $ABCCF, $BYRN, $TPB, $HCI, $MAG, $CWCO, $FSM, $AORT, $GAIN, $WMK, $AMSC, $LFMD, $WLDN, $NVEE, $KRKNF, $STEW, $CASH, $ATEN, $ACMR, $DGII, $BBSI, $FLGT, $SKE, $CTLP ( ▼ 0.09% )

This list was generated using the Magic Watchlist V2 Google Chrome Extension.

More Resources

Free TradingView indicators you can use right now in your account. Don’t have a TradingView account. Click this link to get one.

Magic Order Blocks [MW] https://www.tradingview.com/script/mC37KVoz-Magic-Order-Blocks-MW/

QQQ and SPY Price Levels [MW] https://www.tradingview.com/script/uthqQCwb-QQQ-and-SPY-Price-Levels-MW/

Magic Linear Regression Channel [MW] https://www.tradingview.com/script/qm2pmUW4-Magic-Linear-Regression-Channel-MW/

ATR Bands (Keltner Channel), Wick and SRSI Signals [MW] https://www.tradingview.com/script/lH6Yze4x-ATR-Bands-Keltner-Channel-Wick-and-SRSI-Signals-MW/

Bollinger Band Wick and SRSI Signals [MW] https://www.tradingview.com/script/cqTYgepJ-Bollinger-Band-Wick-and-SRSI-Signals-MW/

Price and Volume Stochastic Divergence [MW] https://www.tradingview.com/script/jnsqx9W9-Price-and-Volume-Stochastic-Divergence-MW/

Multi VWAP from Gaps [MW] https://www.tradingview.com/script/EqIgibII-Multi-VWAP-from-Gaps-MW/

Multi VWAP [MW] https://www.tradingview.com/script/L8cxNVC7-Multi-VWAP-MW/

MW Volume Impulse https://www.tradingview.com/script/c8A2cQb7-MW-Volume-Impulse/

PositionSizeCalculator.net - Don’t forget to size your positions based on the amount you are willing to risk.

The End

If you like this newsletter, let me know, and please share. If you don’t like it, please tell me why, and I’ll do my best to make it better. And remembre, if you have any questions, feel free to reach out to me on Reddit, X.com, TradingView, or Youtube. If for some reason you forget, you can always get those details from the footer at mwright.com