- Trading Advice for Losers

- Posts

- More Winning

More Winning

The bull market is back

⭐ Join our subscriber community at mwright.com ⭐

Introduction

Welcome back. In this issue we’ll review some new stock picks, look at last week’s “also rans”, and review my portfolio performance. Also, for a second week in a row, a TradingView video I posted was selected as an Editors’ Pick, we’ll quickly review that too. Lastly, I’ll share a little bit about myself, and explain the motivation behind my desire to provide you with useful information and successful strategies.

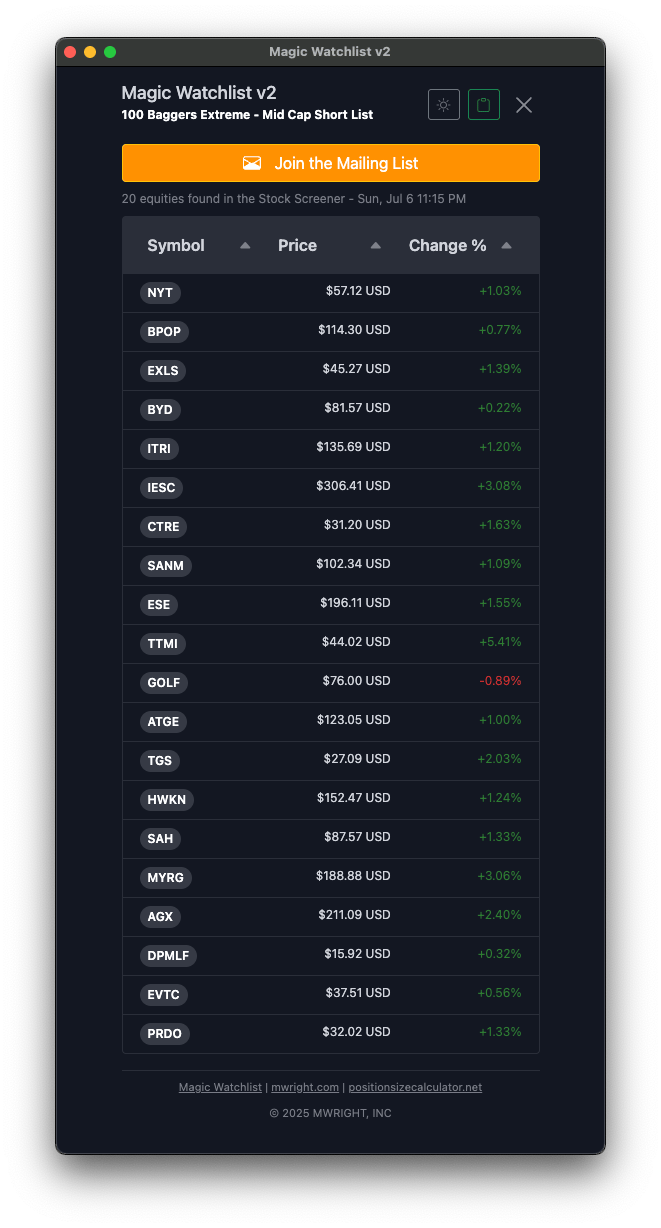

My 100 Bagger screener has been exclusively filtering for small cap stocks. But, someone on Reddit asked about how large cap stocks perform under the same filtering criteria. What I found was that larger cap stocks are large cap stocks for a reason. Nearly 300 large and mid-cap stocks fit the criteria versus about 50 (right now) for small caps.

To filter them down, I tried looking at mid-cap stocks (capitalization from 2B to 10B) and narrowed it down to 73. Then I reviewed the charts for return on equity patterns and reduced that to 20. All of them bangers. And all, but one, were up on Thursday, June 3rd.

Mid Cap Stock - Short List

But then I thought about looking for increasing ROE and reduced float on both large and mid-cap stocks. That left me with 3, $RSG (Republic Services), $RBC (RBC Bearings Incorporated), and $SAPGF (SAP AE).

$RSG has been getting hammered since the beginning of June, but in the last 5 years, its 50 daily simple moving average has only crossed below its 200 SMA twice. That speaks a lot to consistent performance. Watch this for when it begins to turn up.

I could be wrong about it not being ready now, though. Last week’s also rans, $UNTY (+6.37% since the last newsletter) and $AMSC (+10.71%) took off like rockets last week. $ODC (+2.39%), and $DCO (+3.00%) did about the same as $RBCAA. As far as last week’s official picks, $RBCAA and $MCSI, they are up 2.68% and down -0.07% respectively, but both charts look set to take off.

Portfolio Performance

All of my stock buys from the past few months have been based on my 100 Baggers selection criteria. They have not disappointed. I spread them across different accounts to see if there was any difference between the performance as new stocks began to appear in the screener.

Portfolio from PositionSizeCalculator.net Companion Spreadsheet

With a new tool that I’ll be announcing next week, I can sort them by account, by purchase date, and I can compare them to $SPY for any given start date. What I’ve found is that every account has outperformed $SPY. By nearly a factor of 2! This is starting with my first set of purchases on 5/22/2025. $SPY is up 6.27%. My portfolio is up 11.18% (Not including 2 stop losses at 10% and a 79% take profit on $AEVA.

We should all know that past performance does not guarantee future results, but with $SPY reaching all-time highs, we might be in for a nice run until August shows up and ruins the party, like it’s been doing for the past few years.

TradingView Editors’ Pick - Again

Last week I submitted a video “idea” to TradingView about debugging Pine Script, TradingView’s proprietary programming language, titled “Debugging Pine Script with log.info()“. Once again, I was awarded with TradingView’s Editors’ pick for the article.

TradingView Editors’ Pick - Debugging Pine Script with log.info()

It described the use of the log.info() function. A tool that hardly anyone knows about, because it has only been available for about 2 years. I got lucky and found out about it someplace that I don’t remember, and it was a game changer.

The Magic Order Blocks [MW] and Magic Linear Regression Channel [MW] indicators that I built are both complex and use matrices, which can be notoriously difficult to debug. Without this logging feature, I don’t know that I would have even tried to build those. If anyone out there is interested in having mini-tutorials on Pine Script in this newsletter, let me know.

A Little About Me

About a year ago, my digital agency had a contract end that effectively cut my income down to zero. Knowing this would happen, I spent the last 2 years building scripts on TradingView, and doing some deep learning about market dynamics.

In that time period I’ve spent well over $100,000 in time and money - trading, learning how to trade, building free open source tools on TradingView, as well as building other trading tools. As my website says, I strongly believe that by creating tools for building financial freedom, I can add real value to people’s lives.

I’m about fresh out of savings, so my portfolio performance has extra meaning for me and my family. What also has meaning is the fact that you took the time to read this far. Those of you that have chosen to subscribe mean the world to me. Thank you for your support, and I hope that this newsletter has been able to add value to your trading journey.

Sunflower from my garden

Building a business is a lot like building a garden. It can be a direct reflection of your vision. And, if you’re consistent in your work and intent, nature will assist and ultimately reward your efforts.

More Resources

Free tools that you can use today to improve your trading

Free TradingView indicators you can use right now in your account. Don’t have a TradingView account. Click this link to get one.

Other cool tools

The End

If you like this newsletter, let me know, and please share. If you don’t like it, please tell me why, and I’ll do my best to make it better. And remembre, if you have any questions, feel free to reach out to me on Reddit, X.com, TradingView, or Youtube. If for some reason you forget, you can always get those details from the footer at mwright.com