- Trading Advice for Losers

- Posts

- The 2 Best Trading Youtube Influencers

The 2 Best Trading Youtube Influencers

Bravos Research and Carmine Rosato

⭐ Join our subscriber community at mwright.com ⭐

Introduction

Welcome back. In this issue we’ll do a brief review our 2 favorite trading Youtube influencers, Bravos Research and Carmine Rosato. We’ll also briefly retell our position on $SPY. TLDR - It’s going back to $500, and likely below.

I am not an expert, and you should not treat any of what is said in this newsletter as financial advice. It’s just my opinion. The opinion of an average trader that has had some success, and many failures.

What makes my opinion different, though, is that I’ve spent the last two years coding trading indicators and strategies full-time to supplement my own trading. And, I’ve been building apps and websites since the browser was invented.

You can access all of the tools that I’ve built at https://mwright.com. Indicators. Calculators. Strategies. Browser extensions. Etc.

Bravos Research (formerly Game of Trades)

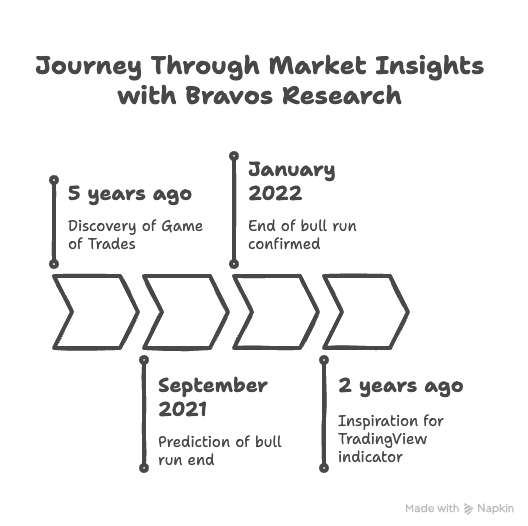

When I first started watching Game of Trades 5 years ago (now re-monikored as Bravos Research), what struck me was the lack of bias in their assessments, and the number of different ways they would look at the market both figuratively and literally. Their approach would be explained in simple language and visualized with charts that no one else seemed to be talking about.

They didn’t have a political direction. They didn’t care if the market was bearish or bullish. They weren’t tied to any particular investment vehicle. What they talked about was raw data, and what they found was always tied back to what was on the horizon for the general market and crypto. Yield curve inversions. Bond prices. The different impact that metals like copper, gold, and silver have. Inflation. Jobs. Presidential cycles. You name it. They analyzed it for the benefit of their viewers.

To make all of this data understandable, they would find patterns that no one else would have noticed, then adjust comparative inverted, time-shifted, or unmodified charts with animation. No one else even comes close to the attentian to detail that they’ve been doing nearly every few days for over 6 years.

What sealed the deal for me was a video that they made in September, 2021 calling for an end to the bull run in January 2022. The video was titled “Why The Bull Run Will End in January 2022... | History Repeats”. They nailed it. And from that point on, I was a resolute fan. Their work was the inspiration for the MWRIGHT TRADING Magic Linear Regression Channel [MW] indicator on TradingView. For about 2 years they had been basing a lot of their projections on a 10 year channel of $SPY. I wanted an easy way to replicate that, which is why our indicator was built.

Bravos Research is legit.

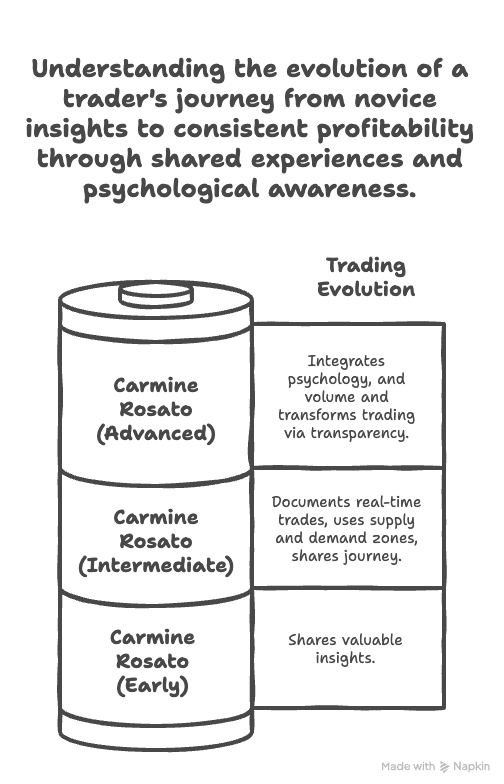

Carmine Rosato, on the other hand seemed like just another trader with a few valuable insights. Occasionally he would post a video about how he made one or two-thousand dollars options trading. Today, Carmine shares his trades publicly and will regular have documented, real-time trades of over $15,000 with losing days never being more than $4,000.

He attributed part of this success to his transition to options from futures. Back in November of 22 he posted a video titled “Make More Money Consistently Trading Futures (/ES vs $SPY)” - https://www.youtube.com/watch?v=DWvVzVVqHYM. Then he began to use volume analysis more with Bookmap, volume profiles, and order trees becoming his go to tools. And for the past year, he seemed to have closed $100K/mo in profits on a regular basis. AND, he was kind enough to share his journey.

One other thing that differentiates Carmine from other traders was his insistence on the importance of both market and personal psychology in trading. He’s discussed in-depth in various videos the why and how of the trader’s state of mind in being a successful trader. It’s not something that’s new, but he mixed this with the days when he losing days, and discussed his own personal challenges in trying to return to successful trading patterns.

I like Carmine. He’s honest and up front. But, I’ve recently discovered another aspect that either he didn’t discuss, or didn’t notice. That is the act of being observed. In the past month, I started posting trades on my paper account on X.com. The fact that other people can see the trades makes it so that I’m more self conscious about not trading impulsively. Except Friday. I traded impulsively on Friday. But, otherwise, the account went from about $107K to $135K using the strategy I discussed in previous newsletters.

What this means to me is that his act of being transparent may have helped transform his trading to an even higher level. Just a theory. In any case, he’s the second of my top 2 Youtube influencers.

$SPY Analysis

Our opinion on $SPY hasn’t changed much from the last 2 weeks. It’s currently headed back toward the baseline of the 10 year Magic Linear Regression Channel [MW] that we’ve shown the last two newsletters. It hit the baseline, then had the dramatic “dead cat bounce” that we called in the April 6th newsletter titled “A Predictable Trading Pattern”. We expect it to likely consolidate there at around $500 before heading one leg lower. Although, we’re more confident in $450 than in $420 as a lower bound, because of previous reversals at the Fibonacci band between the baseline and lower channel border. There is still a chance that the 10 year channel baseline could serve as a support that’s strong enough to hold, but we’re not convinced that will be the case.

$SPY 10-Year Channel

More Resources

Free TradingView indicators you can use right now in your account. Don’t have a TradingView account. Click this link to get one.

Magic Order Blocks [MW] https://www.tradingview.com/script/mC37KVoz-Magic-Order-Blocks-MW/

QQQ and SPY Price Levels [MW] https://www.tradingview.com/script/uthqQCwb-QQQ-and-SPY-Price-Levels-MW/

Magic Linear Regression Channel [MW] https://www.tradingview.com/script/qm2pmUW4-Magic-Linear-Regression-Channel-MW/

ATR Bands (Keltner Channel), Wick and SRSI Signals [MW] https://www.tradingview.com/script/lH6Yze4x-ATR-Bands-Keltner-Channel-Wick-and-SRSI-Signals-MW/

Bollinger Band Wick and SRSI Signals [MW] https://www.tradingview.com/script/cqTYgepJ-Bollinger-Band-Wick-and-SRSI-Signals-MW/

Price and Volume Stochastic Divergence [MW] https://www.tradingview.com/script/jnsqx9W9-Price-and-Volume-Stochastic-Divergence-MW/

Multi VWAP from Gaps [MW] https://www.tradingview.com/script/EqIgibII-Multi-VWAP-from-Gaps-MW/

Multi VWAP [MW] https://www.tradingview.com/script/L8cxNVC7-Multi-VWAP-MW/

MW Volume Impulse https://www.tradingview.com/script/c8A2cQb7-MW-Volume-Impulse/

The End

If you like this newsletter, let me know, and please share. If you don’t like it, please tell me why, and I’ll do my best to make it better. And remembre, if you have any questions, feel free to reach out to me on Reddit, X.com, TradingView, or Youtube. If for some reason you forget, you can always get those details from the footer at mwright.com